Markets Have a Positive Week

Mortgage markets improved last week with investors’ fear of risk in the stock market. Mortgage shoppers benefited from major stock indices touching 12-year lows as investors moved investible cash to the bond market.

For only second time this year, mortgage rates ended the week lower than where they opened.

Lots of Big News

Some of the bigger stories that caused mortgage rates to drop slightly last week included:

- Unemployment reaching 8.1 percent nationwide

- The Fed reducing its economic outlook for 2009

- Investor concerns for blue chip General Electric

Banks Have to Cut Back

In addition to an already big news week, US Bank and Wells Fargo cut dividends by roughly 85 percent each. Both banks are considered extremely well-run and were heard saying these cuts as a way to bolster balance sheets. Markets took it as a negative instead.

Specifically, What Did Those Reports Say?

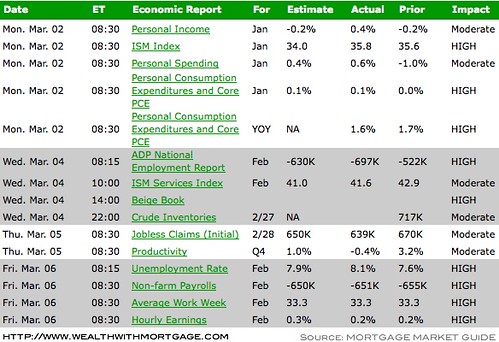

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!