It’s No Secret

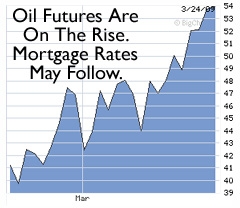

Don’t look now but oil prices are climbing.

This should worry today’s home buyers and would-be refinancers because some of the same forces that helped to push crude past $50 for the first time in 4 months also cause mortgage rates to rise.

March 18, the Federal Reserve committed an additional $1.15 trillion to support the economy.

The Aftermath

Since the announcement, investors have questioned whether the Fed is purposefully spurring inflation. The Fed’s total debt purchases now total $1.75 trillion.

Inflation Nation

As always, to finance its purchases, the Federal Reserve is printing new money, beating up the U.S. dollar along the way. This then leads to inflation which, all things equal, causes oil prices to rise, gas prices to rise, and mortgage rates to go with them.

As we’ve seen the last few summers, oil prices and mortgages seem to touch their yearly high points while the weather is warmest. Get ready.

(Image Kudos: The Wall Street Journal)