A Volatile Week

Mortgage markets were up-and-down last week as rates fell Monday and Tuesday before surging higher from Wednesday through Friday.

In some cases, after touching all-time lows, conforming mortgage rates added a half-percent in the second half of the week, ruining some homeowners’ chance to lock on existing refinances.

It was the second week in a row that mortgage rates worsened.

Reasons for the Increase in Rates

One reason why mortgage rates are up is because investors are starting to turn bullish on the economy, even as it sputters. Crazy, huh?

From investors’ perspective, the data is weak, but not as weak as it has been — or could have been. It’s a glass-is-half-full approach and it’s the opposite of how Wall Street worked in 2008.

Big News For Last Week

Consumer Confidence measured a paltry 26.0 — but the reading was up from February’s all-time lows

Consumer Confidence measured a paltry 26.0 — but the reading was up from February’s all-time lows- The Case-Shiller Index showed a big drop in home prices — but the report ignoresstrong housing data from the last 60 days

- Unemployment rates reached 8.5 percent nationally — but employment is a lagging indicator for the economy

In time, we’ll learn whether investors were on-time or premature in their bets for an economic turnaround but, for now, the mere belief that the economy is improving is leading mortgage rates higher. And until Wall Street’s sentiment changes, rates should continue in that direction.

Specifically, What Did Those Reports Say?

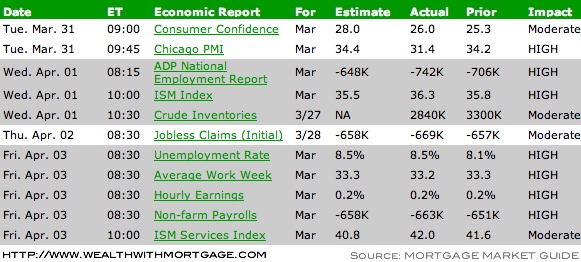

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing.Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!

(Image Kudos: The Wall Street Journal Online)