Good News For The Economy Is Bad News For Mortgage Rates

The economy reflected stronger-than-expected news last week. Unfortunately, this reignited fears of inflation on Wall Street. The ‘positive’ economic news caused conforming mortgage rates to rise by another 1/2 percent last week. This marks the second week in a row of soaring mortgage rates and the fifth week out of six that rates have moved higher.

Conforming mortgage rates are now as high as they’ve been all year and rest at the levels of December 2008.

The News That Keeps Giving

The biggest news of last week is likely to influence mortgage rates this week as well.

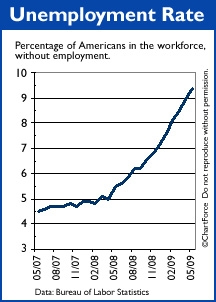

On Friday, we found out that 345,000 Americans lost their jobs in May. Yes, that’s an awfully large number, but itt wasn’t nearly as bad as Wall Street had expected. On top of that, the Unemployment Rate rose to over 9 percent.

Again, the number looks bad, but the data may be a positive. This is because the Unemployment Rate measures Americans in the workforce versus the unemployed that are actively looking for jobs.

If the number of people trying to re-enter the workforce starts to surge, it’s basic math that Unemployment Rates will rise. This is what some economists think happened last month and it served as the backdrop for Friday’s rate surge. Interesting, huh?

Specifically, What Did Those Reports Say?

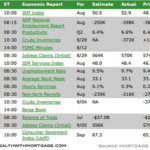

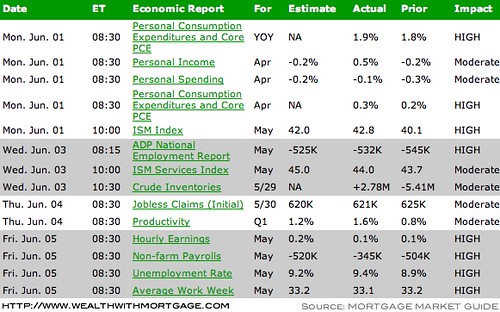

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!