The Ugly Reminder

Mortgage rates soared again Monday, tacking on a half-percent in a day for the second time in under a week.

For reference, each half-percent adds $62 to a $200,000 home loan’s monthly payment, or $744 per year. No, it’s not the end of the world, but it’s real money.

For reference, each half-percent adds $62 to a $200,000 home loan’s monthly payment, or $744 per year. No, it’s not the end of the world, but it’s real money.

I Can Relate

For home buyers recently under contract, it’s a tough time to be shopping for a home loan. Morning mortgage rates have been typically gone by early-afternoon and — in some cases — lenders have changed rates five times in one-day span. Yea, no kidding.

Why’s It Happening?

The reasons for surge in rates are varied, but each is related to the idea that the economic recession may be nearing its end.

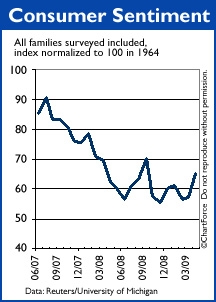

- Consumer optimism is the highest as it’s been all year.

- Consumer spending is falling at a slower pace than in past few months.

- China’s factories reported an expansion in business.

Each of these points is good news for the economy and pushes Wall Street investors towards more risky investments. As a result, “safe” investments get sold — including mortgage-backed bonds, the basis for conforming mortgage rates.

In short, the bad news, is less bad. Therefore, investors are hopeful. The rates show that.

For as long as the future of the economy remains in question, expect mortgage rates to remain volatile. We won’t get half-point rate swings or five pricings in a day every day, but both are becoming more common.

Be careful when shopping for a mortgage — the rate you’re quoted may not last long.

The Future

It should also be said that this spike is likely not permanant. Rates move on a daily basis, so if you are still in the process of shopping for a home or if you’re over 30 days from a closing date, don’t lose sleep over this. I’m sure rates will come back slightly, it’s just a matter of how much.

If you’re in the market to refinance and were holding off for low 4% range, I think it’s time to reconsider your objectives and get realistic. The next sweep down may be your last chance, and I don’t think mortgage rates are going to 4%.