Number of Homes Sold Soars

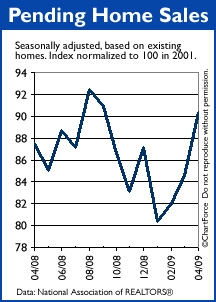

The number of homes under contract to sell increased significantly in April, climbing nearly 7 percent nationwide versus just a month ago.

It’s the third straight month that the Pending Home Sales Index gained and the biggest monthly jump since October 2001, the month prior to the end of the Early 2000s Recession. Crazy, right?

What’s a Pending Home Sale?

A “pending” home sale is one that’s under contract to close, but has yet to do so.

The Pending Home Sales Index is an imperfect statistic because not every home under contract makes it to closing, but the data can a reliable indicator of home buyer activity.

Why Are Sales Up?

It’s not tough to understand why homes-under-contract are spiking:

- There’s a $8,000 tax credit for first-time home buyers

- Conforming and FHA mortgage rates are hovering near 5 percent

- Home prices are still relatively soft nationwide

- Financing is still readily available

These elements are combining to make homes more affordable than they’ve been in the recent past. In April, the Home Affordability Index posted its second highest reading since 1970.

Looking Forward

We can’t know if home prices will rise or fall moving forward, but if Pending Home Sales translate into closed home sales, it’s obvious that home values will be pressured to rise. Remember, each closed transaction takes a home “off the market”, reducing the supply of available properties.

If demand rises while supplies fall, sellers might regain the upper-hand in negotiations and then higher prices are the inevitable result. Seller’s market, anyone?

An estimated 80 percent of all Pending Home Sales close within 2 months. Just give it a little time, these statistics support a good housing recovery on it’s way.