Mortgage Markets Improved Again!

But, surprisingly, given last week’s data and domestic story lines, rates should have rose.

- The Federal Reserve stated that the economy continues to strengthen

- Consumer Confidence pushed to a two year high

- Fourth Quarter domestic output exceeded Wall Street’s expectations

Usually, events like these draw money away from the bond markets and into the stock markets and Wall Street preps for better corporate earnings. The movement forces mortgage rates to rise.

Last week, however, different stories took the headlines including a new report from Standard & Poor’s that said U.K. banks are no longer counted among the world’s most stable (I’m not particularly surprised at this). This research specifically triggered a “flight-to-quality” among investors that pumped the U.S. dollar and sparked new demand for mortgage bonds.

It’s one reason why we ended the week on a crazy rally. It just goes to show how unpredictable mortgage rates can really be.

Specifically, What Did Those Reports Say?

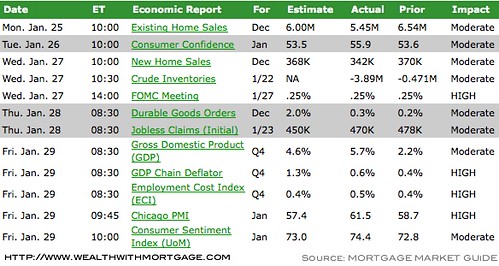

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!