Three Weeks In a Row of Rising Rates

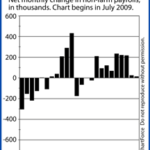

It’s a bit late, but I wanted to explain what the heck happened last week in the mortgage market. As you may have heard, the mortgage market roller coaster continued. Markets worsened badly in the early part of last week, before rallying into Friday’s close.

Overall, mortgage rates were slightly higher for the week even though, they rose to levels not seen since November 2008. Unfortunately, last week marks the third week in a row and the sixth out of the last seven that mortgage rates increased.

The Good News That Was Hidden In The Mess

Fortunately, all It’s not all bad news for mortgage rate shoppers. The market’s surge last week appears to be slowing and its momentum may start to reverse.

See, mortgage rates don’t come out of thin air. They’re based on the price of mortgage-backed bonds and over the last few weeks, it seems as if nobody on Wall Street wanted anything to do with them. It was a massive sell-off that caused bond prices to plummet and mortgage rates to soar.

Press Vs. Professionals

Freddie Mac says rates are up 3/4 percent in the last 3 weeks but if you ask a loan officer, they will tell you that’s undercutting it. Conforming mortgage rates are up more than 1 percent since Memorial Day. No kidding.

The professionals know that the biggest reason for the sell-off was that markets were fearing a runaway inflation scenario. The U.S. Treasury has assumed an unprecedented debt load this year and to repay it, markets expect the government to print more cash. Which is an inflation producing scenario.

However, when a number of high-profile investors and a country said last week that their faith in the U.S. economy remains strong, markets viewed it as an endorsement of government-issued debt. It served as Thursday and Friday’s rate-dropping catalyst.

Specifically, What Did Those Reports Say?

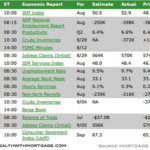

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!