Are You the Right Fit for an ARM Loan?

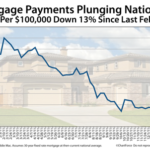

According to the Freddie Mac weekly mortgage rate survey, the relative cost of a 5-year ARM is dropping versus its 30-year fixed-rate cousin.

During the first 5 months of 2009, the products ran neck-and-neck. Today, they’re a half-percent apart.

On a $200,000 home loan, that’s a difference of $60 per month.

Adjustable-rate mortgages aren’t for everyone, but for the right household, they can be a terrific fit. A few scenarios that warrant consideration of a 5-year ARM include persons:

- Buying a home with an intent to sell within 5 years

- With a 30-year fixed mortgage and plans to sell within 5 years

- Interested in low payments and comfortable with longer-term interest rate and payment uncertainty

Make an Informed Decision

Additionally, with homeowners with existing ARMs may want to consider taking on a new ARM, if only to extend their initial, fixed rate period.

Before choosing an ARM, make sure to speak with your loan officer about how adjustable-rate mortgages work, and what causes them to adjust. Although conventional ARMs are limited in how far they can adjust, it’s important to know the risks.