Mortgage rates are higher after the Fed released their notes.

Known as the “Fed Minutes”, the report details the conversation and cross-currents that led to the Federal Reserve’s decision to vote “unchanged” on the Fed Funds Rate after its last meeting.

The Fed Minutes are the lengthy companion to the more famous, succinct post-meeting press release.

As a comparison:

- Press Release: 383 words

- Minutes: 6934 words

The extra level of details is a big deal because Wall Street is perpetually in search of clues about what the Federal Reserve is going to do next.

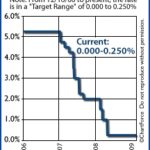

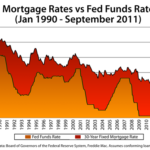

The Fed Funds Rate May Rise as Early as April 2010

In the past week, multiple Federal Reserve members hinted that it could be that soon. Fed Chairman Ben Bernanke even alluded to it, too.

The minutes revealed that the economy may improve even faster than was previously expected, too.

These acknowledgements are part of the reason why mortgage rates are up. Because the Fed Funds Rate rises to accommodate a growing economy, the prospect of economic recovery is drawing money into the stock market and away from mortgage-backed bonds.

Less demand for bonds means a lower prices which, in turn, leads to higher rates.