Home Prices Are No Longer in Free Fall

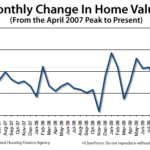

According to the Federal Housing Finance Agency, the Home Price Index posted its first quarterly increase since 2007 last quarter.

The news was reported Tuesday.

The Home Price Index is an interesting metric. It’s huge in its scope, accounting for every home sold in the country that backs a mortgage bound for Fannie Mae or Freddie Mac with two notable exceptions:

- It doesn’t track new construction

- It doesn’t track multi-unit homes

Because the Home Price Index makes these specific exclusions, and because it doesn’t account for FHA and jumbo mortgages, some analysts discount the HPI’s relevance. They prefer the private-sector Case-Shiller Index instead.

Both Reports Have Their Own Set of Flaws

For example, it excludes condos and co-ops, and only tracks sales in 20 cities nationwide. But, of all the private home valuation models, Case-Shiller is the most well-known and most widely-used.

The Case-Schiller Index was also released Tuesday and the report showed the same results as its government-issued counterpart — home values increased between the second and third quarter.

When the Home Price Index and Case-Shiller Index reach similar conclusions, markets tend to buy-in. Home buyers should, too.

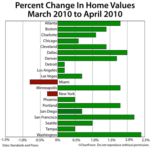

Home values have likely bottomed and are starting to turn higher, as shown in two separate reports. High sales volume and dwindling supply are contributing factors. So are low mortgage rates and a tax credit.

If you’re on the fence about buying a home, at least consider your options. In 2010, homes are unlikely to be as cheap to buy, or as cheap to finance.