New Rate Sheets Came Out Every Few Hours

Data was sparse through 2010’s first trading week last week, setting the stage for a week of momentum trading.

In up-and-down trading, mortgage pricing improved overall but the best rates of the week didn’t last long.

Rates improved Monday and Tuesday as an oversold market corrected itself to better price points. Then, in anticipation of the December jobs report, rates worsened Wednesday and Thursday. Friday, after the jobs report was released, pricing proceeded to carve out a huge range before settling unchanged.

On average, lenders issued new rate sheets every few hours last week. It was a difficult week to shop for mortgages in Iowa and elsewhere.

Specifically, What Did Those Reports Say?

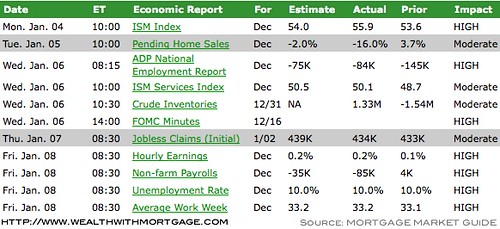

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!