There is Two Sides to Every Economic Coin

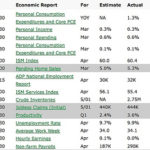

Despite the headlines, it’s important to remember that December’s jobs report wasn’t all bad news.

Sure, the economy shed 85,000 jobs last month and the Unemployment Rate failed to dip below 10%, but for home buyers and rate shoppers in Ankeny , the news was just fine.

The soft employment data led mortgage rates lower, making homes in Downtown, for example, more affordable for buyers.

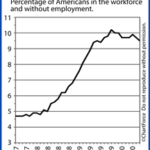

Since early-2008, the U.S workforce has been closely tied to home financing. As the economy slowed and jobs were lost, Wall Streeters pulled money from the risky stock markets and moved it to of the relative safety of bond markets, instead.

Safe haven buying led mortgage bond prices higher which, in turn, caused rates to fall. Mortgage rates fell to 6 all-time lows in 2009. In a related statistic, 4.2 million jobs were lost last year.

As a General Rule, Rates Drop with Negative Economic News

And this is why Friday’s non-farm payrolls report was so good for buyers.

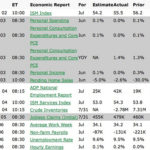

See, in November, the economy added new jobs for the first time since 2007, housing looked strong, consumer confidence was growing. The safe haven buying reversed and mortgage rates took off. Analysts believed the nation’s economic turnaround was complete.

But now, after December’s jobs report returned to the red, Wall Street is forced to rethink its position. Safe haven buying is back and mortgage rates are lower because of it.

Over the next few months, expect a lot of this back-and-forth action in rates. In general, positive news for the economy will be met with higher mortgage rates and negative economic news will be met with lower mortgage rates. There will be exceptions, but the general rule should hold.