Mortgage Rate and Market Recap for the Week of September 7th – September 14th, 2008

Another Refinance Boom is Born

You may have heard that interest rates dropped nearly 1% on Monday. You’d be right. The reasoning can easily be explained. Honestly, the sequels are never as good as the original, so check it out here. The great news about the recent drop in interest rates is that it’s likely to stay around for a while. With Fannie and Freddie being seized by the US Government, confidence has been restored (at the expense of us taxpayers…) and investors are putting their money back into mortgage backed securities.

Let’s face it. It had to be done. No trolling in the comments. Seriously.

Fears of Another Collapse Loom

Later in the week, it has become very apparent that Lehman (a large investment firm) is facing some severe issues. If large companies like Lehman go down, it’s not a sexy sign for the US economy. At this point, everything’s speculation – so I’ll just leave it be.

Just watch the news and follow the story. It will without question be a market mover.

What Did Those Reports Say?

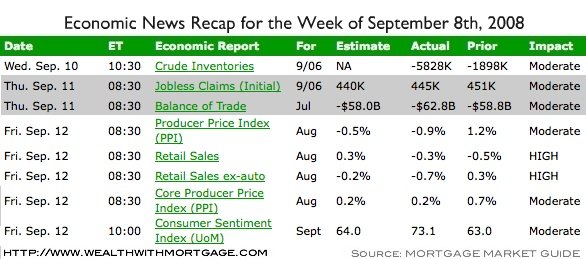

Each week, I put up an economic calendar of news coming out that following week. Here’s the results from last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (That’s these calendars).

- International News. (major events, war related, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team would love to help!