Mortgage Rate and Market Recap for the Week of September 29th – October 3rd, 2008

The Bill Gets Passed!

All week traders were waiting for the big decision. Everyone sat on the sidelines to see if the bailout bill would pass. On Friday, it happened. Rates still managed to stay level with where they opened earlier last week.

Big News Summarized

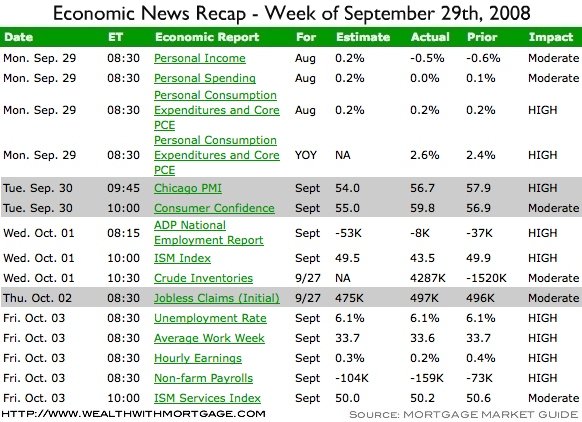

Even though mortgage rates didn’t change a whole lot, it was still an extremely busy news week. Here’s the summary:

- Year over year PCE (Inflationary News) was slightly higher than last year. This is normally bad news for mortgage rates.

- Initial jobless claims were above estimates. Estimates were 475k and the actual figures were 497k.

- Unemployment stayed unchanged at 6.1% (nationally).

What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the results from last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team would love to help!