Is The “Credit Freeze” Over?

If the unfreezing of credit is extremely important to an economic rebound, the first signs of a thaw might actually be here.

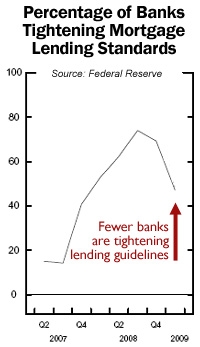

Last Monday, the Federal Reserve released its quarterly survey of 84 member banks. In it, the Fed says that fewer than half of its responding banks tightened “prime” mortgage guidelines over the last 3 months.

This is good news for active home buyers and others looking for a new mortgage.

So, What’s A Prime Mortgage?

“Prime” is a loose term with respect to home loans, but it usually refers to mortgage applicants who have:

- Equity or downpayment in a home

- Credit scores over 740

- Excessive income versus debt

Dissecting The News

By looking at the Fed’s survey, we can conclude that because less than 50% of banks made credit less available, more than 50% did not. Borrowing money may not be easier for prime borrowers, but it’s not harder, either. Put one on the board for the housing market, this is good news.

Even with this said, guidelines remain restrictive.

Looking Back

In the 12-month period beginning late-2007, banks continuously tightened down on low credit scores, low downpayments, and high debt-to-income levels. While all this was happening, Fannie Mae added new fees based specific loan characteristics and second mortgages practically vanished from the marketplace.

The cumulative outcome of these actions keeps many Americans from participating in the current Refi Boom. The good news is that if the trend reported by the Fed continues, lending may get easier a bit later this year. This would definitely provide a boost to housing and to the economy.

Experts believe that the tightening of credit helped create this recession. The loosening of credit, therefore, may be the way out.

How You Can Prepare

Things are definitely changing and some borrowers being told no right now, may qualify in the next few months. The only way to take advantage of future offers is to have a mortgage professional that can keep you informed. If you don’t have someone to help you do that, I’d love to be your guy.