The Fed Extends Their Buying

So, the mortgage markets scored big gains last week, sparked by the Federal Reserve’s pledge to buy $750 billion more mortgage-backed bonds in 2009. That’s on top of the previously announced purchases.

Conforming mortgage rates fell on the week, overall.

With Good News For Rates, Bad News Also Followed

But Federal Reserve intervention wasn’t the only good news for rate shoppers last week. New evidence showed — for the time being, at least — that the U.S. economy may be reversing direction:

- Homebuilders are breaking ground on new homes again

- First-time jobless claims are falling

- Inflation is present and, therefore, deflation is not

Remember, Good New for the Economy is Bad News For Mortgage Rates

Should the economy continue trend stronger through the summer, it will likely fuel stock market gains, drawing cash away from mortgage bonds. This would lead mortgage rates higher — perhaps for good.

Today’s levels are artificially low, after all, supported by government intervention more than economic fundamentals. After the Fed’s Wednesday afternoon announcement, rates fell to all-time lows before recovering sharply into the weekend on economic optimism and fears of inflation.

Specifically, What Did Those Reports Say?

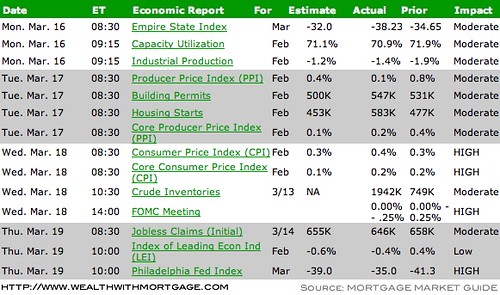

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!