Give and Take

For the third week in a row, mortgage markets improved early in the week, only to give back the gains before Friday’s close.

Mortgage rates ended last week exactly where they started. However, if you locked your mortgage rate Tuesday, you got a rate decidedly lower than someone who waited until Friday. It just goes to show you that getting a great rate is all about timing and the right advice!

Earnings Are Up!

Last week, one of the biggest mortgage rate drivers was a series of surprisingly strong corporate earning reports, including large firms like Goldman Sachs and Citigroup.

The positive reports pushed the Dow Jones Industrial Average to its 6th straight weekly gain. We’re now on the market’s longest winning streak in two years! Furthermore, its best 6-week rally since 1938 when talking in percentage terms. That’s pretty amazing, really.

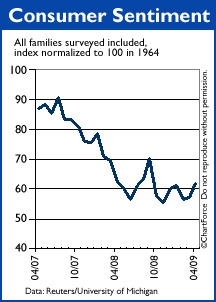

More American’s Are Feeling Better About The Economy

Part of the rally could be credited to boosting Consumer Sentiment. According to a recent survey, Americans are feelingbetter about the economy than at any time since last September’s meltdown. Yea, it’s a short period of time, but it’s a great sign.

What Does A Stronger Economy Mean For Mortgage Rates?

Remember, while stock market rallies and rising consumer sentiment can be good for our investments, they’re not always welcome when we’re shopping for mortgage rates. The bond market is considered a “safe place” for money, an alternative for when stock markets are risky.

As a result of this improving stock market, bonds (what mortgage rates are based on) start to sell-off so investors have more cash available to invest in equities (the stock market). Bond prices suffer when this happens and, because mortgage rates are based on the price of mortgage bonds, mortgage rates suffer, too.

If you’re not working with a professional that is pointing these interesting specifics out to you during the process, you should consider interviewing more. There is better advice available!

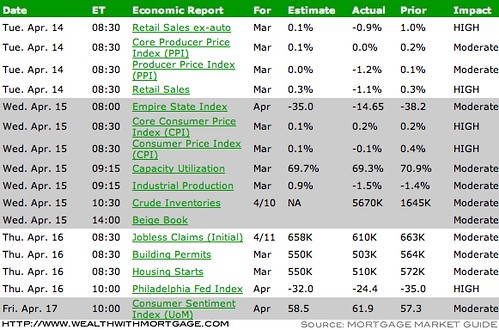

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing.Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!