Statistics Don’t Lie

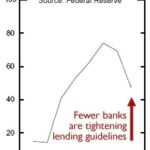

It looks like banks are less scared of mortgage loans these days.

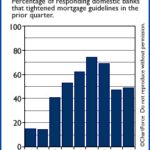

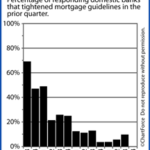

In its quarterly survey to member banks, the Federal Reserve asked senior bank loan officers whether “prime” residential mortgage guidelines had tightened in the last 3 months.

Just one-fifth of banks said guidelines tightened last quarter, a dramatically lower figure versus last quarter — a signal that mortgage underwriting may get less restrictive in the months ahead.

Looking Past the Numbers

It is worth noting, however, that not a single responding bank said its guidelines had eased. For now, getting through underwriting is still much tougher than it was 2 years ago.

Some of the changes today’s borrowers face include:

- Higher minimum FICOs

- Larger required downpayments and equity ownership

- Higher income levels versus monthly debts

- Larger reserve requirements

Furthermore, second mortgages are scarce when loan-to-values exceed 80 percent.

The underwriting changes of the last 24 months preclude many Americans from getting access to today’s low rates if the Fed’s reported trend continues, that could reverse before the end of the year.

Some analysts claim that credit tightening started the U.S. recession. Credit loosening, therefore, could help end it.