Mortgage Rates Have Risen in Each of the Past 3 Weeks

Mortgage markets worsened last week on better than expected economic data, causing mortgage rates to rise.Last week was the third consecutive week that mortgage rates moved higher and, since touching a multi-month low in early-October, conforming mortgage rates are up by about a half-percent.

It’s likely rates will continue to rise, too. That’s because the same force that held rates down for so long is now the force pulling them up — expectations for the U.S. economy.

Over the last 6 months, it wasn’t clear in what direction the country was headed. The housing sector has been gaining in strength, but the rest of the economy has been a question mark.

Last week put an end to some of those questions:

- Retail Sales posted stronger-than-expected results

- Consumer Sentiment matched September 2008 levels

- Jobless and continuing claims fell below consensus estimates

Expectations for the U.S. economy are changing on the fly. As a result, stock markets gained last week and mortgage markets lost.

Specifically, What Did Those Reports Say?

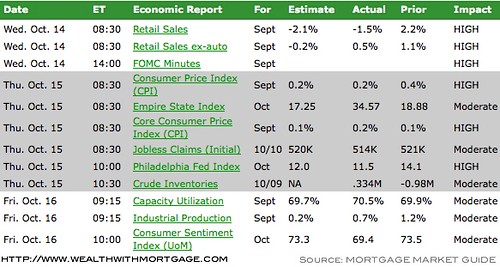

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!