Volatile Markets Have Been the Theme in 2009

Rates carved out a wide range on the week, culminating in a late-Friday plunge that dropped rates by about 1/8 percent.

It was the first time in 5 weeks that mortgage rates fell.

Volatility like that of last week is nothing new on Wall Street; it’s been a running theme in 2009. Volatility occurs when markets don’t agree on what’s next for the economy and, this year, there’s been a lot of disagreement like that.

Data has been inconsistent. Take last week for example.

At 9:00 AM Tuesday morning, the Case-Shiller Index showed home prices rising nationwide. Because many analysts believe housing fueled the recession, strength in the sector is widely construed a positive for the economy.

Mortgage Rates Are Constantly Changing

But then, an hour later, the national consumer confidence report revealed a substantial deterioration in sentiment versus the month prior. The data forced Wall Street to do an about-face.

Housing is important to the economy, but it can’t affect growth like consumer spending can. When Americans are less confident about their future income, they tend to keep their wallets closed, retarding economic growth.

Holiday Shopping Season is getting underway and the last thing businesses want to see is a suddenly reserved American shopper.

Specifically, What Did Those Reports Say?

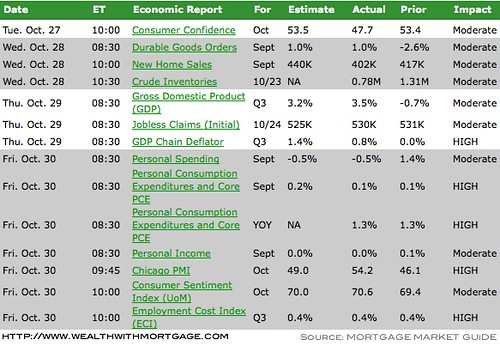

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!