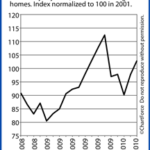

Tough Mortgage Approvals Are Becoming More ‘Normal’

The economy’s improving but lending standards are not. Nationally, banks are making mortgage approvals harder to come by.

Unfortunately, underwriting guidelines are getting tighter.

The information comes from the Federal Reserve’s quarterly survey to its member banks. The Fed asks experienced bank loan officers around the country to report on “prime” residential mortgage guidelines over the most recent 3 months and whether they’ve tightened. These guys aren’t shy, they tell the truth.

For the period October-December 2009:

- Roughly 1 in 4 banks said guidelines tightened

- Roughly 3 in 4 banks said guidelines were “basically unchanged”

Only 2 of 53 banks said its guidelines had loosened. What were those guys smoking?

There Are Signs Everywhere

Combine the Fed’s survey with recent underwriting updates from the FHA and generally tougher standards for conventional loans and it’s clear that lenders are much more cautious about their loans than they were, say, in 2007.

Today’s Ankeny home buyers and would-be refinancers face a few new hurdles including:

- Higher minimum FICO scores

- Larger downpayment requirements for purchases

- Larger equity positions for refinances

- Lower debt-to-income ratios

So, if you’re on the fence about whether now is a good time to buy a home, or make that refi, consider acting sooner rather than later. It doesn’t necessarily matter that mortgage rates are low, or that there’s an up-to-$8,000 home purchase tax credit for households that qualify. With each passing quarter, fewer and fewer applicants are eligible to take advantage.

If you’re looking to beat the changes, feel free to contact me. I answer all of my emails promptly, and I’d be happy to help you out!