Let me save you some time and money.

The Fed does not control mortgage rates. Not at all. The Fed can do many things to influence the economy, but one of those things they control is NOT mortgage rates. Influence, yes. Control, no.

Let me explain.

What Does The Fed Control?

Now that I’ve established the Fed doesn’t control mortgage rates, it’s important to realize what the Fed does control.

- Fed Funds Rate – This is the rate that banks are charged directly from the Fed for overnight funds. (More at Wikipeida).

- Discount Rate – This is similar to the Fed Funds Rate (FFR), but often used to simply increase liquidity. (More at Wikipedia)

Since I’m not focusing on these two items, I’ll leave the extra reading to you.

What Does A Fed Movement Mean to Mortgage Rates?

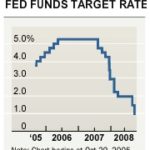

Okay. Now what you came for. There are three moves the Fed can make in regards to the Fed Funds Rate each meeting.

- Keep the FFR unchanged.

- Decrease the FFR.

- Increase the FFR.

Obvious, yes.

Now, let’s put our ‘Trader’ hat on and think about what these movements mean to the economy and markets in general. I promise this will all come together at the end…. PROMISE.

- Unchanged means more of the same. If the Fed doesn’t see a need to step in and take action, you can expect the economy to do more of what it is currently doing.

- Cutting rates means cheaper money. This also (often) implies that consumer spending will increase. When Americans spend more money, they also drive inflation higher. Remember that.

- Hiking rates means more expensive money. Common sense would tell you this leads to decreased consumer spending. As the Fed makes money more expensive, the rules of supply and demand kick in and fears of inflation go away.

What’s Inflation Got To Do With It?

A valid question.

Now that we’ve established that mortgage rates are not based on the Fed Funds Rate, It’s important you know what they are connected to. The answer is mortgage backed securities. These are special bonds. If the value of a mortgage backed security increases one day, mortgage rates go down. If the value of a mortgage backed security decreases, mortgage rates go up. Make sense?

Remember, a bond is an investment that promises a certain return on your money each month. So, an investor puts their money in mortgage backed securities for that purpose. A certain return on their investment.

Now, the question Americans should be asking is “What does a Fed Cut mean to mortgage backed securities?” Well, I’m glad you asked!

If an investor knows that inflation will be a concern in the future, they’ll want more return on their money. Because after all, they want to continue getting the equivalent return on their investment. So, they actually push down the value of a mortgage backed security (by trading them in the market) and that results in higher mortgage rates.

Don’t Believe Me? Here’s a History!

I tell this to every client when we’re looking at locking an interest rate around a Fed meeting. It’s always the same conversation. “Yes Tyler, this makes sense, but I still don’t believe it.”

Well, here’s what I show them next. If this doesn’t prove my point, I’m not sure what will.

So, as the value of mortgage backed securities (MBS) go down, mortgage rates go up.

Roughly, every 25bps is equivalent to .125% in rate. Roughly.

So, you can see there have been some pretty big swings in mortgage rates shortly after the Fed’s actions.

Now You Know

No surprises any more. Fed cuts lead to inflation. Inflation leads to higher mortgage rates. If history has a way of predicting the future (which it normally does), you can expect a Fed cut to lead to higher mortgage rates.

Bond History Chart Courtesy of MortgageMarketGuide.com

{ 1 trackback }