Taking Action

When it comes to mortgage rates, sometimes it’s better to “act now”. For clarification, it is no longer the time to “act now”.

When it comes to mortgage rates, sometimes it’s better to “act now”. For clarification, it is no longer the time to “act now”.

On Tuesday, mortgage rates fell to their lowest levels in 4 years. It happened because the Fed said it would “employ all available tools” to resuscitate the economy. Not because they cut the fed funds rate, as you know from previous conversation the two are not connected at all.

Quick Reversals

On Wednesday, however, the mortgage markets had second thoughts.

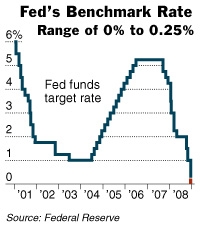

After considering the long-term implications of a near-zero percent Fed Funds Rate and the cumulative cost of government intervention to-date, suddenly, traders grew fearful that U.S. government action would devalue the dollar and lead to inflation — the enemy of low mortgage rates.

As a result, mortgage markets unwound. Quickly.

At first, the exit was a slow and orderly. Then, without warning, investors began a full-on sprint for the exits. By the end of the day, mortgage rates were higher by as much as a half-percent. Nearly all of Tuesday’s big gains were erased.

Learning From This Experience

In hindsight, the reversal Wednesday wasn’t all that surprising — it’s the same trading pattern we’ve seen twice already this year. The first time was after the Fed’s “surprise” rate cut in January, and the second time was after the federal takeover of Fannie Mae and Freddie Mac in September.

If history tells us anything, sharp rate drops tend to be followed by immediate bounce-backs.

But, unfortunately, not every would-be refinancing homeowner saw the increase coming. While those that locked at the first opportunity to save money are sitting pretty today, the rest that “waited for rates to go lower” are likely kicking themselves about it.

Going forward, mortgage rates may fall, or they may not. We can’t possibly know. But we’ve now seen the pattern 3 times now — when mortgage rates plunge like they did Tuesday, they rarely stay that low for long. When you find a rate you like, get in and get locked as soon as possible.

Sleeping on it for even one night may end up costing you dearly. I’m sure this speaks volumes to many mortgage rate shoppers!

Be Prepared for the Next Drop

As you may have heard in prior posts, we’re unique at Four Legacies Mortgage. We offer free mortgage management services. This means that when rates drop like they did, we go on a locking spree. History shows that mortgage rate drops like this only last a few hours at most. Waiting isn’t smart. Locking in and moving quickly is.

Check out more about our auto-lock program here. I think you’ll really like it. Feel free to drop me an e-mail if you have any questions about our program.

Also, don’t jump and refinance after you miss the lows. That’s just silly. Often times when we’re looking to refinance, we just want to save money on the interest rate. However, what if you initiate the process and lock at say 5.375% and then rates fall to 4.5% again. Would you be bummed? I thought so.

Rates will eventually come back down with the volatility we see in the market. The key is working with a loan officer that understands the mortgage market.

In the meantime, keep your seat belts on. This will be a bumpy ride.

(Image courtesy: The New York Times)