FOMC Meetings Make a Big Impact on Market

The Federal Open Market Committee starts a 2-day meeting today in Washington.

The scheduled get-together ends at 2:15 PM ET Wednesday after which the FOMC will issue a press release to the markets.

Consider locking your mortgage in advance of the press release.

The FOMC meets 8 times annually and its adjournments are among the biggest market-movers of the year.

The Fed’s post-meeting press release is a direct look into the mind of the Federal Reserve and Wall Street is looking for clues anywhere it can find them.

After its August 2009 meeting, the FOMC said in its press release:

- Financial markets have improved, relative

- Household spending remains constrained

- Although weak, the economy is “leveling off”

Since then, however, credit risks have lessened on Wall Street, consumer spending have shown signs of life and Fed Chairman Ben Bernanke said the recession is “very likely over”.

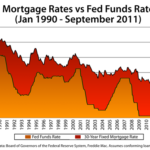

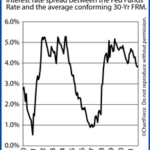

Rates Rise With Strong Market Growth

This is why tomorrow’s FOMC press release is so important. Markets don’t expect the Fed to raise or lower the Fed Funds Rate, but they do expect the Fed to shed light on its next series of moves.

If the Fed alludes to inflation and stronger growth ahead, mortgage rates should rise. By contrast, reference to slower growth ahead should help keep rates steady.

The FOMC is expected to leave the Fed Funds Rate within its target range of 0.000-0.250 percent — the lowest it’s been in history. However, it’s what the Fed says Wednesday that will matter more than what the its does.

If you’re floating a mortgage rate or wondering if the time is right to lock, the safe approach is to lock prior to 2:15 PM ET Wednesday.